Growing Shopify sellers usually struggle with cash flow at some point or another. It’s a balancing act between cash coming in and out of your business as you fuel your growth.

To help with cash flow, you might need to look to outside financing to help. You can use it to invest in that next round of inventory, keep running marketing ads and campaigns, or pay off expenses like payroll and shipping costs.

The problem? Getting access to capital as a new or growing eCommerce business can be tough. You don’t always have the business history to qualify for traditional loans. But, you also might not be aware of alternative financing options that you can take advantage of.

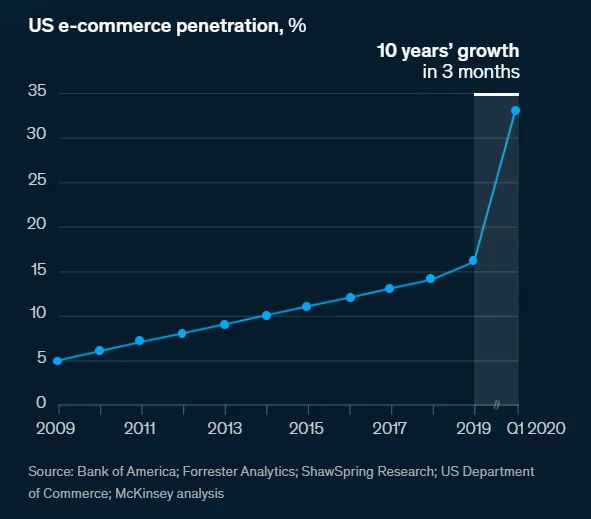

Last year, 10 years of eCommerce growth happened in just 3 months at the height of the pandemic.

And, more business owners than ever turned to online channels to sell. In fact, Shopify reported that new stores created on their platform grew 71% in Q2 2020 compared to Q1 2020, with a record number of merchants added in Q3.

But the reality is that many new small businesses will fail. About 20% of U.S. small businesses fail within their first year. By the end of their fifth year, roughly 50% have closed their doors. After 20 years, only around a third of businesses have survived.

Small businesses fail for all sorts of problems, but a main reason is the inability to manage money. According to a U.S. Bank study, 82% of businesses that failed cited cash flow problems as a factor. For many owners, organizing payroll and financial records with a simple paycheck example can help maintain transparency and avoid costly mistakes.

Insufficient cash flow is tough to overcome, especially for small businesses. You often don’t have enough cash on hand to weather issues. It’s easy then for financial errors or unexpected challenges (like shipping costs, surcharges, supply chain disruptions) to result in the end of your business.

Small business owners need access to outside capital to grow their business with efficiency and intelligence. It can give you the security you need to grow your business and overcome any hurdles as they come.

The problem? Traditional finance institutions like banks can under serve online businesses. Their outdated underwriting processes aren’t tailored for entrepreneurs and eCommerce businesses.

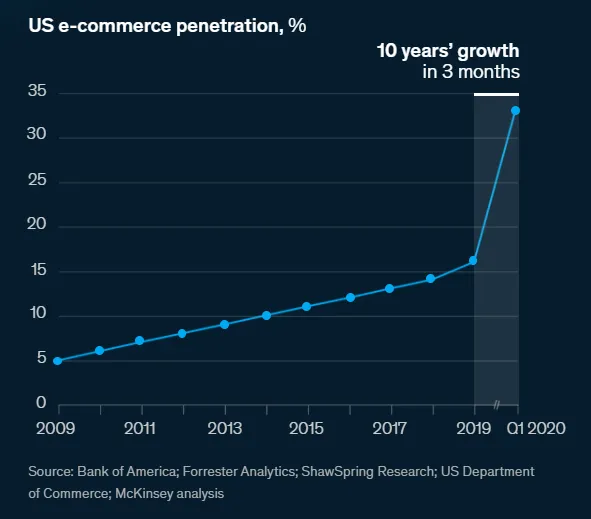

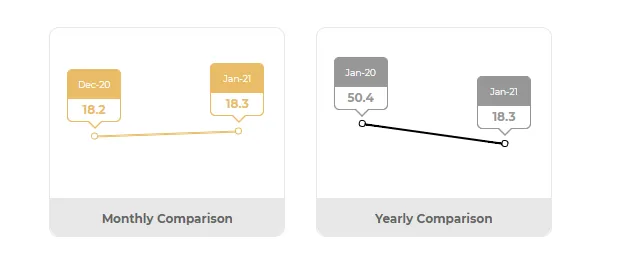

Biz2credit’s lending index indicates that big banks approved just 13.2% of small business loans requests in January 2021. Meanwhile, small banks granted just 18.3%, a sharp decline from 50.4% in January 2020 (as pictured below)

Shopify also reported that 36% of their merchants facing COVID-19-related challenges stated that “My bank or financial institution doesn’t understand the needs of my business.”

Small businesses need anywhere from $10,000 to $80,000 in startup capital. Without it, you can’t finance sales or inventory and usually end up laying off employees.

Today, many businesses are now turning away from traditional institutions and funding options. Instead, they’re using alternative financing solutions that are tailored to online businesses to get access to the cash they need (and when they need it) to survive in the evolving and competitive retail landscape.

Here’s the top ways to find financing as a Shopify seller and/or eCommerce business owner:

In 2016, Shopify started offering their own financing program, Shopify Capital, that offers two types of financing: a merchant cash advance and a business loan.

Funding amount: Between $200 — $1,000,000 USD or $200 to $500,000 CAD

Repayment Terms: There is no interest. Instead, you’ll repay a fixed amount/flat fee by one of these ways.

For more info about Shopify Capital, check out their program’s FAQ. Also, note their current restrictions for capital (at the time of the writing of this blog post).

A tried and true traditional financing method is using credit cards to pay for general expenses and some inventory purchases. And as you make purchases with a credit card, you can rack up reward points and cash back rewards to continue to use for your business.

You can check out business cards from American Express and Chase.

Over the long term though, credit cards alone probably won’t be enough to finance your business. You can quickly outgrow your credit limit, especially with how often you need to make big purchases like inventory. This can lead to maxed out cards, which can still put strain on your cash flow and your credit.

Many brands also turn to venture capital to raise the funds they need. These private equity investors consult with valuation services companies and give you capital in exchange for an equity stake in your business. In other words, you’re giving up ownership of your business to work with a VC.

Over the years, VCs have targeted high-growth sellers, especially DTC brands.

Globally, DTC startups have raised $8 billion to $10 billion on known venture capital across more than 600 deals since the start of 2019.

While venture capital can be a great fit for some brands, it’s not a magical solution for everyone that leads to a big IPO day. Not only are you giving up a significant part of your business, you may also be giving up decision-making power of how to run your business.

So far, there’s been mixed results with VCs. Leading brands like Allbirds, Dollar Shave Club, and Warby Parker have been successful with VC money. But, there’s also been big disappointments like Outdoor Voices, Brandless, and Casper.

The downfall of some VC and eCommerce brand relationships is that VCs expect constant high-growth (even if it becomes unrealistic).

VC firms expect returns of 10 to 15 times their investment— which can cause VC-based companies to only focus on top-line growth, not profitability. This leads to most brands using VC money on paid marketing and acquiring new customers. But, this can quickly turn into a game of “growth at all costs”, even if your business is run into the ground in the process.

Before you take on VC money, just be sure to educate yourself on the process and pick your VC partner with due diligence. When talks progress, you’ll be asked to share financials and other sensitive documents, so using a platform that supports secure document sharing during due diligence helps you stay organized and control who sees what.

VC and eCommerce has been a hot topic in the past year or so. Read more about why some DTC brands are turning their back on it. Instead, these brands are focusing on referral marketing and optimized end-to-end customer experiences to grow at their own pace.

Recognizing the lack of options for eCommerce sellers, there are FinTech companies like Payability that offer cash advances (not a loan or debt) designed for Shopify, Amazon, and eCommerce businesses. Payability’s Instant Advance for Shopify could get you up to $250,000 as soon as tomorrow, and doesn’t require you to have a long business history like traditional bank loans.

Funding Amount: Up to $250,000 (actual amount is typically 75% — 150% of one month’s worth of total sales revenue)

Repayment Terms: There’s no interest, instead you repay with a fixed amount/flat fee. Instant Advance is a purchase of your future receivables (or online sales). As you sell, you’ll remit a fixed percentage of your sales to Payability until the total amount owed is paid back. Similar to Shopify Capital, the daily payment amount changes depending on how much you sell.

Early Payment Benefits: Payability offers you a fee rebate for every week you pay your advance back early. So pay back in half the time and pay half the fee.

Note: You can use your Instant Advance from Payability alongside your Shopify Capital financing to get the total amount of cash you need to operate and grow your business.

Of course, all businesses can head to a bank for a traditional loan (personal, SBA, etc) or a line of credit (LOC) — it’s just a matter of whether you’ll be approved or not. In all cases, they’ll look at your personal credit score, history with the bank, and income to determine your loan amount and APR, so you should be aware of these especially if you're applying for a first-time business loan.

For established businesses, loans and LOC can be a great fit because you have the time in business and years of tax history to meet their qualifications.

Otherwise, traditional loans can have low approval rates for new and growing online businesses. You might not meet their outdated underwriting process (how they decide if you’re approved and for what amount) that favor large, established businesses.

And, you should pay attention if your loan is “secured”, meaning that you have to put up collateral like your house or car to be approved. In the case that you can’t pay back the loan for your business, you’ll owe them your personal assets.

To learn more about your financing options, read this in-depth guide to top funding options as an online business.

Every business is different. What financing is best for your online business might not make sense for someone else. Choosing the best option comes down to a few key things:

And remember, you don’t have to pick just one. You can use many of these solutions alongside each other for maximum benefits.

About the Author

Jillian Hufford has over seven years of educating merchants on digital commerce and marketing growth strategies and best practices. She is a frequent author and thought contributor on DTC and B2B commerce, SaaS software, and B2B content marketing. She also contributes regularly to CMSWire. Connect with Jillian on LinkedIn: @JillianHufford

This is a guest post shared on ReferralCandy. ReferralCandy is a customer acquisition tool used by thousands of ecommerce retailers and business owners around the world.

Grow your sales at a ridiculously

lower CAC.